Below is the VFIAX index fund calculator, which you can use to calculate the potential investment return for the Vanguard S&P 500 Index Fund (Admiral Shares).

Vanguard’s VFIAX large-cap index fund, is an market-cap weighted index fund designed to measure the performance of the S&P 500, the five hundred largest publically-traded US companies.

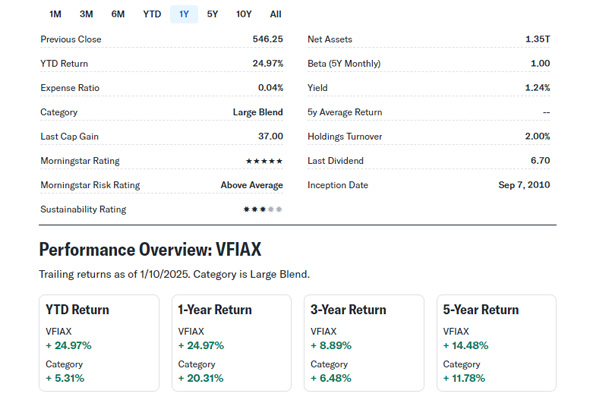

Year-to-date, VFIAX was up almost 25% year-to-date in 2024, after returning 24.3% in 2023. Using that as a rate of return, you can use the calculator below to estimate how much an initial investment would have returned in 2024, and use the length of time to estimate how much a total investment would return.

Remember: Past performance is not a guaranteed indicator of future returns. With that knowledge, it would be a safe estimate to use the formula 22% (2024) + 7-10% (2025) for an estimated 29% to 32% return over a 24-month period.

VFIAX Index Fund Calculator

You can input the amount you plan to invest in VFIAX and the duration of your investment to see how much you could earn.

5 Things to Know About VFIAX Mutual Fund

Fund Inception

VFIAX was launched on September 7, 2010. It has since grown to be one of the largest index funds in the world, with over $1.7 trillion in assets under management as of Q4-2024.

Expense Ratio

The expense ratio for VFIAX is 0.04%, which is significantly lower than the average expense ratio for mutual funds.

Performance

VFIAX has consistently outperformed the majority of actively managed funds and has delivered strong returns for its investors. In the last 10 years, VFIAX had an average annual return of 12.24%.

Investor’s Favorite

VFIAX is a popular choice for retirement accounts, such as 401(k)s, due to its low expense ratio and consistent performance.

Powerful

During the COVID-19 pandemic in 2020, VFIAX suffered a significant decline in value but quickly rebounded.