Can anyone tell me the difference between FXAIX and VTSAX besides the obvious one is Fidelity and one is Vanguard? My major question is why there is no minimum to invest into FXAIX but there is a required $2,500 to start in VTSAX?

Also the fees seem smaller in FXAIX yet the majority of books I’ve been reading tout VTSAX investing rather than individual stocks. What am I missing?

FXAIX is a better choice for investors who want to track the S&P 500, while VTSAX is better for investors who want to track the entire stock market.

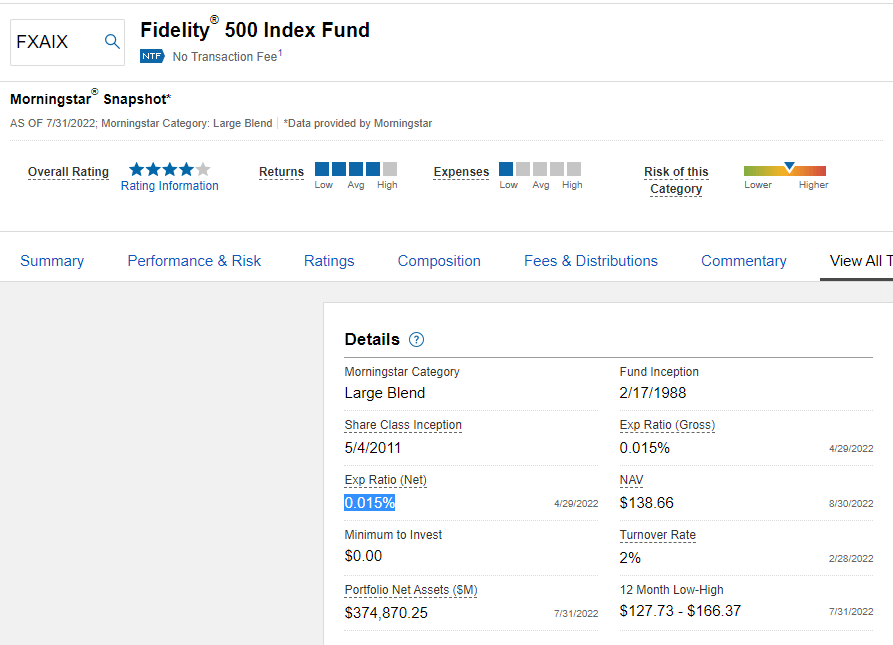

FXAIX: Fidelity 500 Index Fund

FXAIX is a passively managed fund that aims to track the performance of the S&P 500 Index, an index of 500 largest U.S stocks. The fund is managed by Fidelity Investments.

The Fidelity 500 Index Fund has a low expense ratio of 0.015%.

VTSAX: Vanguard Total Stock Market Index Fund

VTSAX is a Vanguard index fund that tracks the entire U.S. stock market and includes over 3,000 stocks.

Because it covers the entire market, it’s considered a very diversified fund. VTSAX has an expense ratio of only 0.04%.

It’s also one of the largest funds, with over $700 billion in assets under management.

FXAIX vs. VTSAX: Comparison Details

| Funds | Fidelity® 500 Index Fund | Vanguard Total Stock Market Index Fund Admiral Shares |

|---|---|---|

| 3-year total return | +26.06% | +25.77% |

| 3-year standard deviation | 17.41% | 18.16% |

| Morningstar rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Min. initial investment | 0.00 | $3,000.00 |

| Net expense ratio | 0.02% | 0.04% |

| Total net assets | 399.36bn USD | 341.73bn USD |

| Symbol | FXAIX | VTSAX |

| Morningstar category | Large Blend | Large Blend |

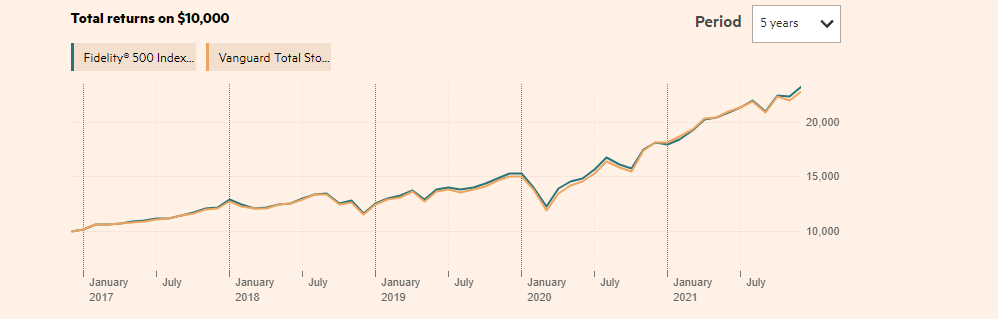

Growth of Hypothetical $10,000

If You Invested $10,000 in FXAIX 10 Years Ago, This Is How Much You’d Have Now: $46,210

If You Invested $10,000 in VTSAX 10 Years Ago, This Is How Much You’d Have Now: $45,226

Trailing total returns

| Funds | Fidelity® 500 Index Fund | Vanguard Total Stock Market Index Fund Admiral Shares |

|---|---|---|

| 1 month | +4.48% | +3.82% |

| 3 months | +11.02% | +9.16% |

| 6 months | +11.66% | +9.09% |

| 1 year | +28.69% | +25.71% |

| 3 years | +26.06% | +25.77% |

| 5 years | +18.46% | +17.98% |

FXAIX vs VTSAX: Key differences

Both FXAIX and VTSAX offer low expense ratios and are suitable for long-term investors. However, there are some key differences to consider when deciding which fund is right for you.

FXAIX is cheaper, with an expense ratio of 0.015%, versus VTSAX 0.04% for VTSAX.

There is a $3,000 minimum investment for each Vanguard fund, including VTSAX, whereas you can invest in Fidelity 500 fund with as little as $1.

FXAIX vs. VTSAX: Which one is better?

📝 Nothing is more valuable than the opinions of actual investors, here’s what real Fidelity customers have to say about FXAIX vs. VTSAX.

Christy D wrote — Nov 6, 2019

Depends on your situation. For me, I use VTSAX, as well as small cap admiral in a Vanguard taxable account. But for my company 401k with Fidelity I hold some FXAIX. Lots of overlap but not the end of the world.

Joseph B wrote — April 12, 2020

VTSAX is Vanguard’s Total Market Mutual Fund. The equivalent at Fidelity is not FXAIX but is FSKAX. The performance differences between VTSAX and FSKAX are really minor because they both just seek to mimic returns of the total stock market. If your brokerage is at Fidelity, just go with FSKAX.

Mark G wrote — April 12, 2020

The differences between VTSAX and FSKAX are so negligible you would never be able to tell.

Ryan S wrote — April 15, 2020

VTSAX is more diversified and has slightly higher returns. If you’re going to choose between one or the other, VTSAX is the winner.

Bahaa O wrote — April 15, 2020

I have an account with Fidelity so to me FXAIX is less fees. Comparing their return, seems Fidelity is better in the 1, 3 and 5 year. They are almost exactly the same in the 10 yr.

If you already have a Vanguard account then just invest in VTSAX. It is the superior fund anyways. It would be silly to open a Fidelity account just to invest in the S&P 500 Index. Vanguard has that too, you know 🙂

Christy D wrote — April 16, 2020

Fidelity has zero expense funds. The comparable one to the Vanguard offering is FZROX. It also has some small and mid cap funds. Yes it’s completely free with no minimums.