Fidelity International Index Fund (FTIHX) and Fidelity ZERO International Index Fund (FZILX) are two funds that can help you diversify your portfolio and achieve exposure to international stocks.

Let’s compare them to get an idea of what each has to offer.

FTIHX: Fidelity Total International Index Fund

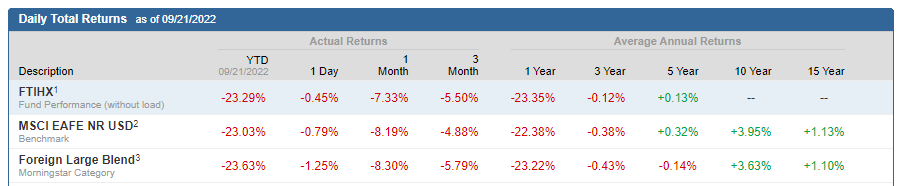

FTIHX is an international index fund that aims to replicate the performance of the MSCI ACWI ex USA Investable Market Index.

As a passively managed fund, FTIHX invests in foreign stocks, providing investors with a way to ingrain in international markets, including Europe and Asia.

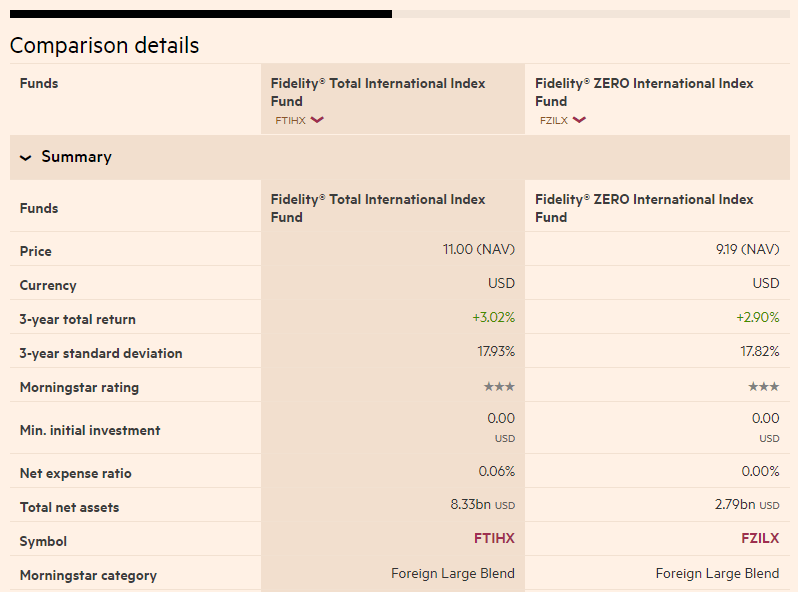

The fund has an expense ratio of 0.06%.

FZILX: Fidelity ZERO International Index Fund

FZILX is another index fund that invests in the international market. It has an expense ratio of 0% and follows the MSCI ACWI (All Country World Index) ex USA Investable Market Index.

With a focus on emerging markets, about 14% of its assets are invested in Japan, 10% in the U.K, 8% in Canada, and 7% in China.

Unlike FTIHX, FZILX does not charge a yearly fee to investors. Because it has no management fees, this fund is a good choice for investors who want foreign stocks in their portfolio with no added costs.

FTIHX vs. FZILX: Key differences

Cost is one of the biggest differences between the two. FTIHX has an expense ratio of 0.06%, while FZILX has no fee at all.

Over the last year, FTIHX has had an average annual return of -23.35%. This is almost the same as the performance of FZILX (-23.45%).

FTIHX vs. FZILX: Which Is Better?

Having a basket of international stocks in your portfolio help to reduce risks and diversify your portfolio. FTIHX and FZILX are capable of providing exposure to the global market.

FZILX is slightly better than FTIHX because of its “no expense ratio” feature.

That said, when it comes to mutual funds with over 2,400 foreign stocks and low fees, we liked FZILX.