The Fidelity ZERO Large Cap Index Fund (FNILX) and the Fidelity ZERO Total Market Index Fund (FZROX) offer investors a simple way to get exposure to the U.S. stock market while charging no fee.

So which one should you choose? We’ll dive into these two funds’ investment profiles and compare their returns over time to help you make that decision!

FNILX: Fidelity ZERO Large Cap Index Fund

FNILX is a mutual fund that primarily invests in large-cap stocks with market caps greater than $10 billion. It has an expense ratio of 0.00% and a dividend yield of 1.15%.

FNILX holds over 500 stocks, with the top 10 holdings accounting for 26% of its total portfolio.

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 7.00% |

| Microsoft Corp. | MSFT | 5.88% |

| Amazon.com Inc. | AMZN | 3.31% |

| Tesla Inc. | TSLA | 2.10% |

| Alphabet Inc. Cl A | GOOGL | 1.96% |

| Alphabet Inc. Cl C | GOOG | 1.80% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.52% |

| UnitedHealth Group Inc. | UNH | 1.43% |

| Johnson & Johnson | JNJ | 1.29% |

| NVIDIA Corp. | NVDA | 1.27% |

FZROX: Fidelity ZERO Total Market Index Fund

If you’re looking to invest in the entire U.S. stock market, FZROX is the perfect candidate.

As of July 2022, FZROX’s portfolio contains more than 2900 stocks. Information Technology takes up approximately 26% of asset allocation, followed by Health Care (14%) and Consumer Discretionary (11.41%).

The Fidelity ZERO Total Market Index Fund has an expense ratio of 0%, similar to its companion.

FNILX vs. FZROX: Key differences

FNILX is a large-cap fund, while FZROX is a total market fund.

FZROX invests in all publicly traded stocks based on their market capitalization, while FNILX focuses on large-cap stocks and excludes mid and small-cap companies.

Let’s take a look at their performance.

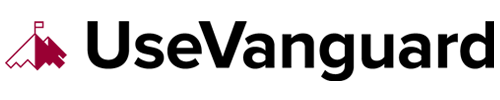

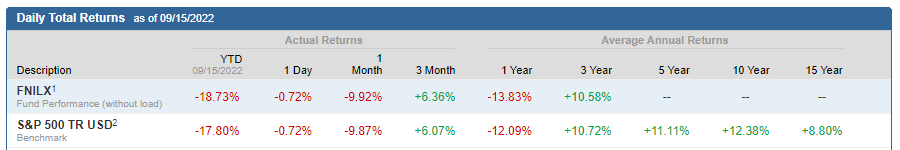

The average return of FZROX for the last five years was 10.15% compared to FNILX’s 10.58%.

Both funds maintained their 10% annualized returns, which is the typical average for the stock market.

If broader market exposure is important to you, consider FZROX over FNILX.