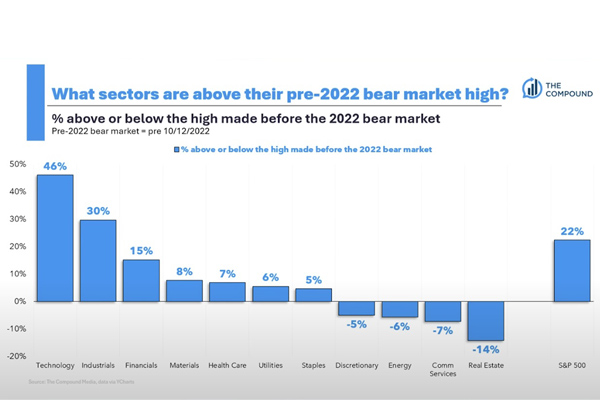

How has the stock market performed since the October 2022 lows? The S&P 500’s market’s recovery has been fueled by strong performances in technology and communications services.

Despite various monetary policy, macro-level business, political and geo-political setbacks, the S&P 500 has recovered 22% these past 24-months and shown resilience, driven by strong earnings in strategic sectors amidst challenging macro-economic factors.

This rebound was supported by controlled inflation and favorable Federal Reserve actions, including a 50 basis rate cut in September 2024 that boosted investor confidence.

Finviz: State Street SPDR S&P 500 SPY ETF

Technology Sector

Since October 2022, technology has experienced remarkable 46% gains, largely driven by advancements in artificial intelligence (AI) and strong earnings from major tech companies. However, investors should be aware of potential volatility and valuation concerns in the sector.

Finviz: Fidelity FTEC Technology ETF

Fidelity’s FTEC Technology ETF: Up 46% since Q4-2022, Up 29% in 2024 YTD

Market Sentiment: While there is optimism about the long-term potential of AI and technology stocks, some market participants remain cautious due to potential overvaluation risks.

Future Outlook: The technology sector is expected to continue playing a critical role in market dynamics, but investors are advised to maintain diversified portfolios to mitigate risks associated with potential market corrections.

Top Performers: The broader S&P 500 Index has benefited from the tech sector’s performance, achieving a return of about 22.08% year-to-date.

- Nvidia (NVDA): Nvidia has been a standout performer, with its stock price increasing by over 150% in the first half of 2024. The company has capitalized on the AI boom, particularly in AI chip production, driving significant revenue growth.

- Broadcom (AVGO): Another major winner, Broadcom’s stock rose by approximately 106.04%. The company’s acquisition of VMware and strong sales of AI-related products have contributed to its impressive performance.

- Microsoft (MSFT) & Alphabet (GOOGL): These companies have also seen substantial gains due to their investments in AI technologies and cloud computing services. Microsoft’s stock increased by about 13.55%, while Alphabet saw a rise of approximately 10.74%

Top Losers: Despite the overall positive trend, there have been instances of volatility within the tech sector. In July 2024, the NASDAQ experienced a significant dip due to underwhelming earnings reports from some tech heavyweights like Tesla and Alphabet.

- Name: Fidelity MSCI Information Technology Index ETF

- Category: Technology Sector

- Inception Date: 10-21-2013

- Expense Ratio Fee: 0.08%

- Assets Under Management: $12B AUM

- Holdings: 294 Stocks

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| NVIDIA Corporation | NVDA | 15.87% |

| Apple Inc. | AAPL | 15.68% |

| Microsoft Corp. | MSFT | 13.59% |

| Broadcom, Inc. | AVGO | 4.48% |

| Oracle Corporation | ORCL | 1.83% |

| Salesforce, Inc. | CRM | 1.82% |

| Advanced Micro Devices, Inc. | AMD | 1.58% |

| Accenture PLC Class A | ACN | 1.47% |

| Cisco Systems, Inc. | CSCO | 1.47% |

| Adobe Inc. | ADBE | 1.42% |

Industrial Sector et all

Coming soon: Industrials , Financials , Materials , Health Care , Utilities , Consumer Staples , Consumer Discretionary , Energy , Communications , Real-Estate.